Straight after ASCO, BIO 2022 was back in person in San Diego, June 13-17. Some 15,000 delegates from around the world attended.

The exhibition hall was packed with national and regional pavilions from every country with skin in the life science game (except, surprisingly and controversially, the UK) and the special biomanufacturing area has grown to take up around 25% of the space.

“The Nordics had a joint pavilion supporting the 100+ companies representing the region’s traditional strengths in cancer immunotherapy, CNS, genomics and protein science, along with new areas such as cell and gene therapy, microbiomics and precision medicine.”

The Nordics had a joint pavilion supporting the 100+ companies representing the region’s traditional strengths in cancer immunotherapy, CNS, genomics and protein science, along with new areas such as cell and gene therapy, microbiomics and precision medicine.

Partnering worked well and sessions were well attended – we organised two on behalf of clients, one on getting psychedelics to the market and another on COVID-19 Brain, which received great feedback.

Left: Iris Örhn from Business Region Göteborg and Charlotte af Klercker from Business Sweden were happy to be back in the Nordics Pavilion. Right: Cytiva, Samsung and Lonza dominated the record-sized Biomanufacturing Zone.

The mood was one of general enthusiasm to meet people in person again, but underlying this were fears of an extended downturn. Experts at the Endpoints Breakfast backed by BIO’s own state of the industry presentation agreed that the next 9-12 months were likely to be rocky, with inflation and the war in Ukraine creating a perfect storm.

“Nevertheless, although raising new funding is tough, it is believed that the majority of companies have enough money to ride out the storm as big pharma is sitting on a huge cash pile and the patent cliff is still there.”

In addition, good news from several company’s trial results is tending to be overshadowed by failures from the raft of preclinical companies that IPOed during COVID. Nevertheless, although raising new funding is tough, it is believed that the majority of companies have enough money to ride out the storm as big pharma is sitting on a huge cash pile and the patent cliff is still there.

The Endpoints Breakfast was a major draw with a lively early morning debate on the state of the sector.

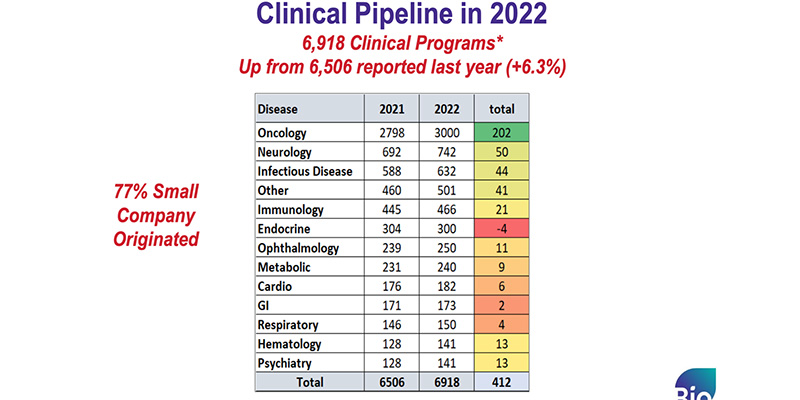

The advice was not to panic by retaining a single asset or entering a one-sided alliance. Two other things BIO zeroed in on were the rise of China with a vast number of well funded new companies being set up there incorporating the latest technology, and the continued lack of innovation in the pipeline beyond oncology, neuroscience and a few rare diseases. Despite the current need, there is little innovation in either cardiovascular medicine or psychiatry although breakthroughs may be achieve through the help of digital biomarkers.

“Two other things BIO zeroed in on were the rise of China with a vast number of well funded new companies being set up there incorporating the latest technology, and the continued lack of innovation in the pipeline beyond oncology, neuroscience and a few rare diseases.”

That’s this writer’s personal opinion, but I also took time out to canvas others, starting with Helena Strigård, Director General, SwedenBIO.

“This was the first time the industry met at a BIO convention since Covid and I believe several felt, like me, how symbolic it is that the very industry that enabled a pandemic to be tackled is now back in business F2F. In terms of the activity on site for the Nordic delegation, it was extremely busy, reflecting the interest that our region is generating in partnerships and investments. Sweden’s second place in Nature’s World Review listing right before the event proved that we have reason to be reaching for the very best partnerships internationally,” Strigård said.

“In terms of the activity on site for the Nordic delegation, it was extremely busy, reflecting the interest that our region is generating in partnerships and investments.”

“Personally, I spent my time in partnering, targeting highly ranked life science companies from all over the world to find B2B opportunities, and to attract them to our Nordic version of the BIO convention – Nordic Life Science Days, which gathers around 1500 delegates from 40 countries,” continued Strigård.

BIO veteran Iris Öhrn from Business Region Göteborg was also well placed to comment.

“Even though the number of attendees was slightly below recent BIO editions, the number of regions and countries exhibiting was not low, showing once again that life science is a priority industry for many countries. A clear picture emerged: life science and healthcare are intertwined with countries’ economic productivity and societal well-being. The Nordics caught the attention of many international investors and corporates as we are one of the regions with the largest pipelines in oncology and CNS, two therapeutic areas with the highest unmet needs,” said Öhrn.

“There are still many challenges remaining regarding bioprocessing for scaling up manufacturing. Probably the pandemic and the renewed interest in the vaccine field have drawn more interest from policymakers, regulators, and public players.”

“ATMP, including gene therapy and cell therapy was also extensively discussed during BIO. Most pharma companies are advancing their drug development pipelines in this field and we will see more and more biologicals and ATMP products reaching late clinical trial phases. There are still many challenges remaining regarding bioprocessing for scaling up manufacturing. Probably the pandemic and the renewed interest in the vaccine field have drawn more interest from policymakers, regulators, and public players,” continued Öhrn.

“It was clear during BIO that to make health systems both sustainable and resilient is one of the key priorities for the future development of the sector. We need to leverage digital tools, focus on person-centered health approaches and make prevention a priority,” said Öhrn.

“One of the key messages of the event was that the public sector needs to deepen the dialogue and involvement with the business community.”

“One of the key messages of the event was that the public sector needs to deepen the dialogue and involvement with the business community. Only by co-investing and co-creating we will be able to build a better future. I myself left the event convinced that only by investing in prevention and a more sustainable approach to health, including financial sustainability, will we be able to make any progress. Public-private partnerships is not any more a ‘nice to have’ – it is a precondition for success,” Öhrn said.

These observations were endorsed by Ylva Hultman of Invest Stockholm who believed an increasing number of inward investment enquiries and collaboration offers show the region is firmly on the map as a global centre for ATMP innovation and manufacturing.

Hanne-Mette Kristensen of Norway’s Life Science Cluster, one of the prime movers behind the Nordic Pavilion, also noted the growing pressure on the sector to demonstrate its ESG and sustainability credentials. She observed: “While the exhibition area always buzzes, I have always heard that the partnering side delivers.”

Martin Welschof, CEO, BioInvent agreed. “I did not attend any sessions, but instead used BIO to continue ongoing partnering discussions and concluded a deal. Of course, the main topic was the current financial climate. This probably will remain the main topic for the coming months,” he said.

“I did not attend any sessions, but instead used BIO to continue ongoing partnering discussions and concluded a deal.”

Newcomer Oskar Lund, CFO, Ilya Pharma had similar observations.

“While the market downturn did put a damper on the general mood (many listed smaller companies mentioned feeling the pain), in-licensing players were very active and there seemed to be lots of interest in gene- and advanced therapies.”

“My thoughts on BIO were that there was a lot of buzz with people very happy to meet in person after two years of virtual-only. While the market downturn did put a damper on the general mood (many listed smaller companies mentioned feeling the pain), in-licensing players were very active and there seemed to be lots of interest in gene- and advanced therapies. Also, quite a few country/regional pavilions were competing with the big industry players over who has the most impressive pavilion,” said Lund.

So on to Boston next year which should be even more successful. Hopefully government support will increase – for example Korea paid for over 1000 delegates!

And to end with my Best of BIO 2022:

Best Pavilion

1) Flanders

2) Samsung

3) Switzerland

Best Session

1) Psychedelics

2) BIO State of the Sector

3) Endpoints Breakfast

Best Party

1) Belgium

2) BioBash

3) Medway

Left: Belgium was among the busiest pavilions and held by common consent the best party. Right: San Diego has perhaps one of the most practical and well equipped convention centres in the US and along with Boston, it is a real favourite with the life sciences community.

Best Newcomer

1) Oregon

2) Lithuania

3) Size of Biomanufacturing Area

Best Freebie

1) Free professional portrait photo (at last says my partner, Amgen & others)

2) Platypus, Victoria

3) State of Emerging Therapeutic Companies – https://www.bio.org/ia-reports

The young Lithuanian team showcased the country’s impressive CRISPR, protein engineering and clinical trials expertise.

Text and photo: Richard Hayhurst, Let’em know. Richard has more than 30 years’ expertise in life sciences PR in Europe.

Richard Hayhurst